Recording Forgiveness of the PPP Loan

PPP Loan Forgiveness How to record forgiveness on the PPP Loan in your books. The PPP Loan, or Paycheck Protection Program, was a federal loan

You recently started a side hustle and the last thing on your checklist is dealing with this ‘bookkeeping’ thing.

Most people dread Bookkeeping it seems tedious, overwhelming or the fact that it is a precursor to taxes… maybe even a bit scary. I get it! But Bookkeeping doesn’t have to be so dreadful.

When we talk about bookkeeping in modern day, we are talking about “Double-Entry Accounting”. While the concept was originally invented by Benedetto Cotreudli in 1458, Luca Bartolomes Pacioli is known as the father of accounting.

Pacioli wrote several books that elaborated on the concept by creating the process and systems to organize double-entry accounting, such as journals and general ledgers, balance sheets and income statements. His books were used for hundreds of years to teach accounting process.

Bookkeeping dates back to 3300 bc, with ancient tax returns recorded on clay tablets in Egypt and Mesopotamia! Historians believe written language may have been created primarily for the purpose of tracking financial transaction! (source)

Without getting to complicated, double-entry accounting is a system in which we account for both sides of a transaction using debits and credits. Debits and Credits are absolutely essential to know if you are an accountant or bookkeeper charging for your services. However, for your side hustle, you can get by with just a basic understanding.

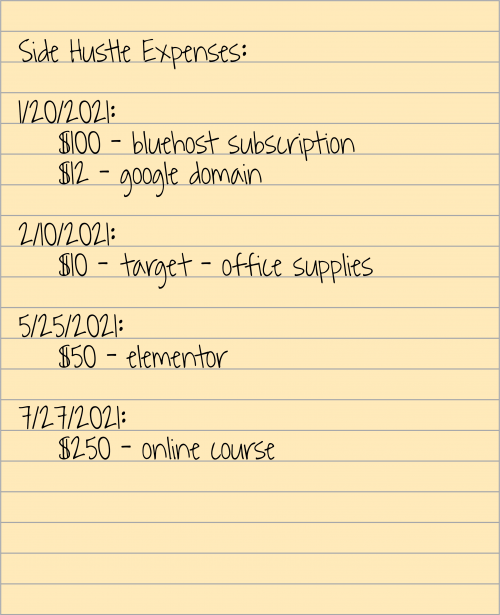

Let’s pretend for a minute that you have been in business for a little while, and since you knew this bookkeeping thing would come up, you took the time to write down all the money you have spent so far.

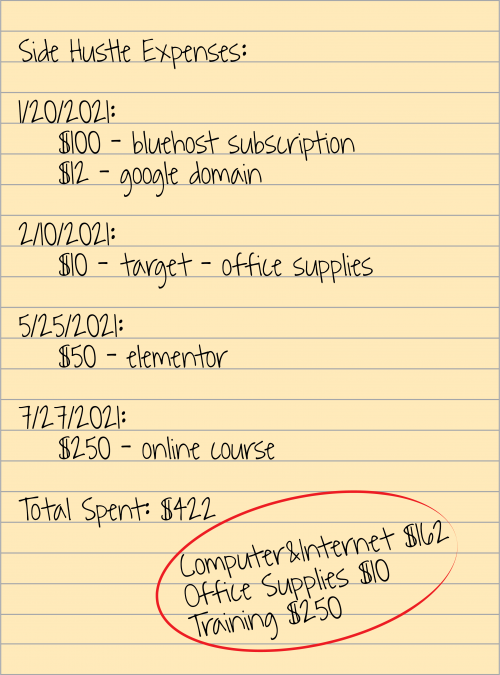

Now that the year is more than halfway thru, you want to get an idea of how much money you have put into your side hustle. You quickly add up the expenses and realize you have spent a total of $422. Taking it a step farther you decide to group these expenses into categories (in accounting these categories are know as “accounts”).

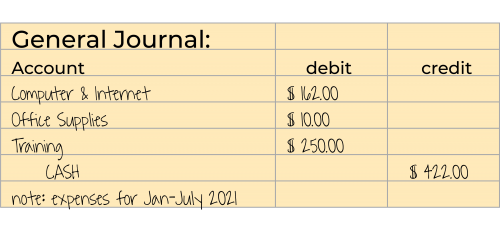

Without realizing it, you just did some double-entry accounting. Here is the summary of what happen in the world of double entry accounting.

In its simplest definition, Double-Entry Accounting, means that we are tracking both side of the transaction, in this case each transaction effects both the expense and cash.

You can easily track your income and expenses using a piece of paper as we saw above.

If your new business is small, and you have not set up a separate business bank account, then you might opt to track your income and expenses using a google sheet.

Or if you have slightly more transaction, you might opt for an accounting software to help you automate the whole process. WAVE is a free software (although I personally found it a little clunky to use). You can get started in Xero or Freshbooks for $11-15/months with their basic plans. And, of course, there is Quickbooks Online, which would be my first choice for most small businesses.

No matter what method you choose, it is totally do-able to be your own bookkeeper! I am on your team! Please reach out if you have any questions!

PPP Loan Forgiveness How to record forgiveness on the PPP Loan in your books. The PPP Loan, or Paycheck Protection Program, was a federal loan

Bookkeeping is the process or tracking and recording business transactions. This post has bookkeeping basics for side hustlers!

The best bookkeeping tip I can give you is to Keep it Simple! Especially when you are starting out! A lot of people who are